6 Bed, Crewe CW1 3BA

Project:

Background & Deal Structure:

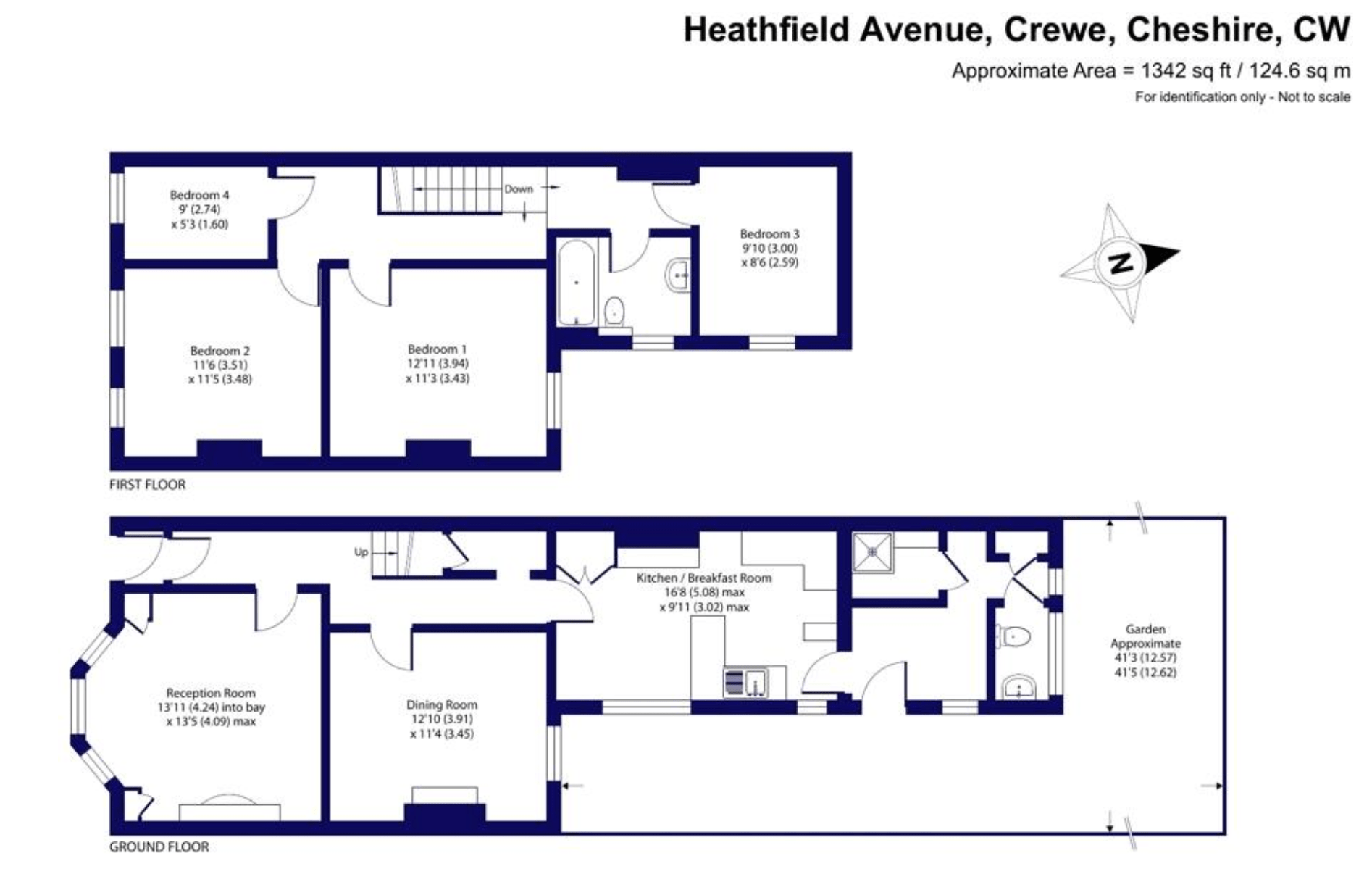

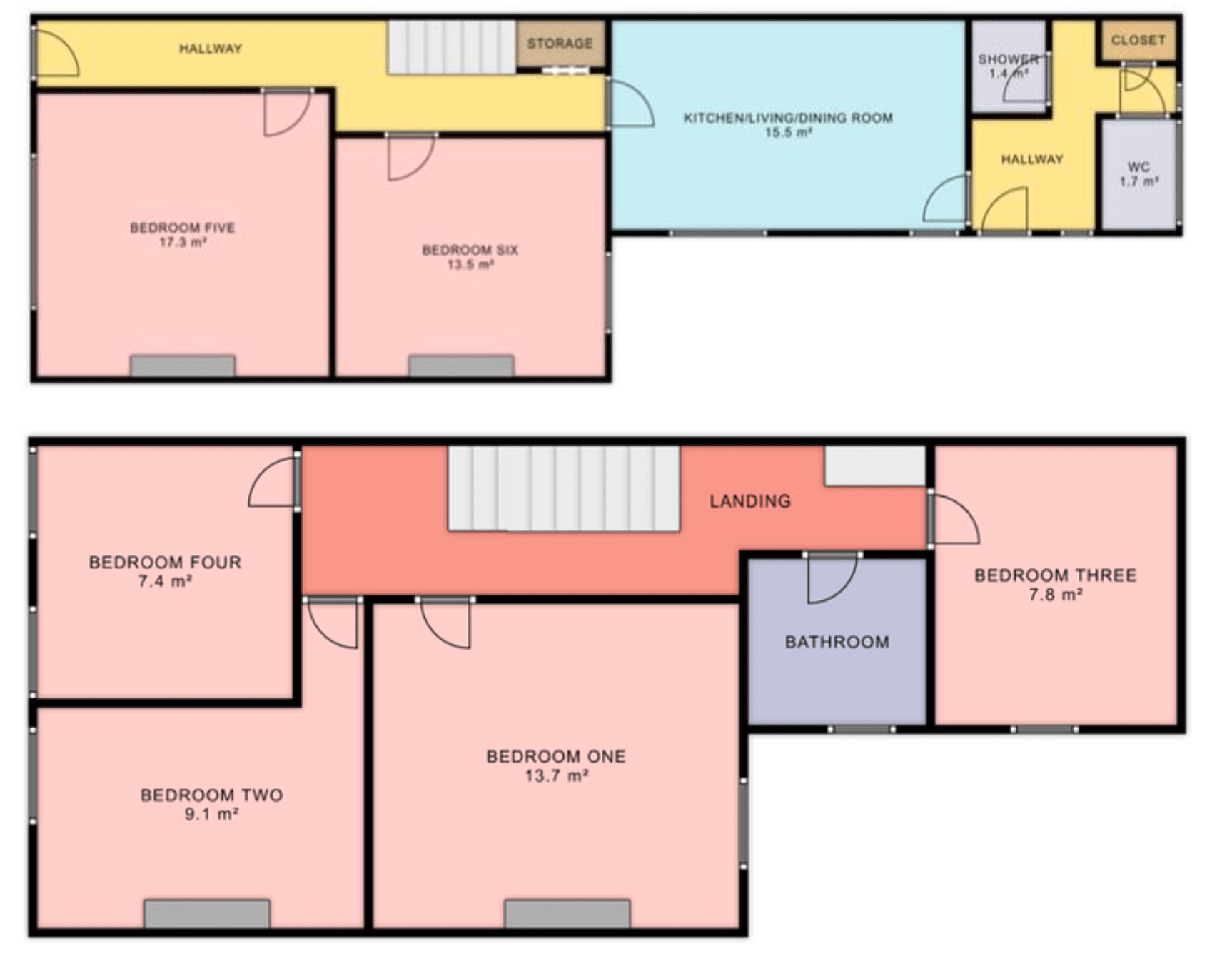

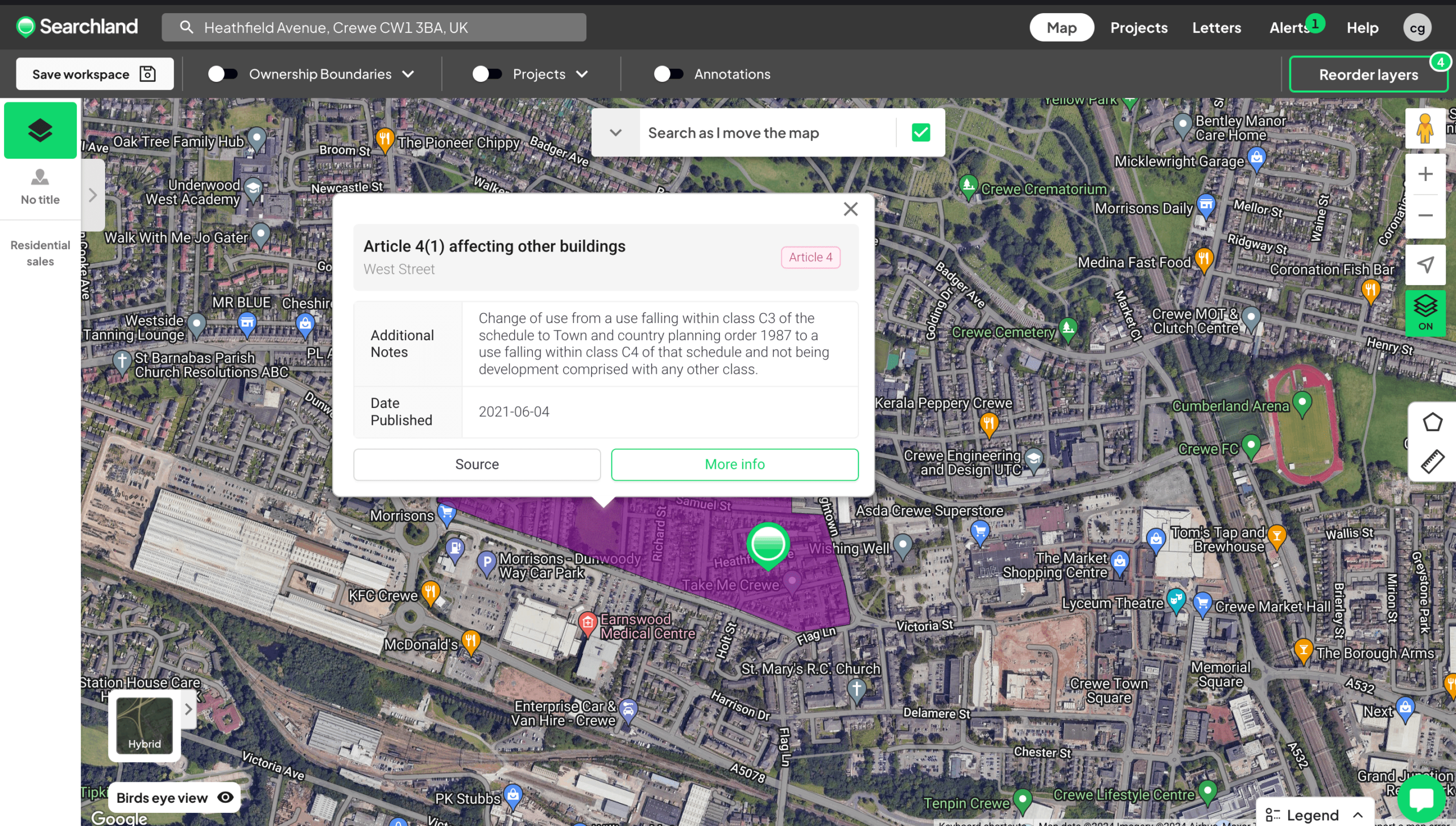

A 4 bedroom terraced property ideally suited for conversion into a 6 bedroom house of multiple occupancy (HMO) and leased to a Registered Provider on a long-term commercial lease.

A Registered Provider (RP) has expressed interest in this property, and it has passed their postcode checks.

The RP have offered a 5 year lease on this unit, following renovation and having onboarded the property.

Deal requires cash or bridge for the front-end purchase due to the scope of works.

Area / Location

Located close to the centre of town, with an abundance of local amenities and facilities, a short distance to the train station and motorway networks providing access to Manchester, Liverpool and beyond, Crewe is well located.

The property is perfectly positioned for access into the town, is in close proximity to many local, national and global employers, and benefits from a variety of local recreation spots including local golf courses, parks and forests

Scope of Work

Moderate scope of works with internal reconfiguration, including…

Rip out all door casings fittings etc as required.

External doors to have ‘Euro’ style thumb-turn locks

Supply and fit fully compliant FD 30 fire door casings, fully compliant FD30 fire doors, intumescent fire strips, architraves, fire door closer, push plate to communal door, fully compliant door lock suitable to specific fire door (‘Euro’ style thumb-turn locks on the inside preferred), door stop to all rooms.

Room sizing studwork adjustments: inc. removal of stud walls as per scheme, form new stud partition with 100mm cavity wall insulation, fireboard and plaster, fit skirting boards and decorate.

Full rewire of electrical sockets, lights and extraction, new consumer unit EICR test and 2 no EML fittings Grade D1 – BS 5839 PT6 Install smoke & heat detection Interlinked smoke detection to all rooms and corridors and 1 heat detector to kitchen area. All bedrooms to have 1 USB Socket and minimum of 3 double sockets in total & Communal area to have 1 USB Socket and minimum 2 double sockets. Kitchen and Bathrooms to have Bulk Head lights.

Fireboard to any supply cupboards.

Carry out all other associated joinery works throughout property to make good existing woodwork, skirting boards etc.

Paint newly formed walls, skirts and touch up throughout the property to match the already existing white finish throughout. Decoration in white emulsion in all rooms

Price for remove & replace existing kitchen.

Price to re-purpose existing kitchen carcasses and faces if possible.

Price for remove & replace existing bathroom suites.

Price to re-purpose existing bathroom suites if possible.

Remove old boiler make good space and install new boiler into kitchen – Combi boiler and Gas Safe Cert.

Jet wash rear garden stones and fence panels and creosote fencing.

New carpets in bedrooms, hallways, landing & stairs. New vinyl flooring in kitchens & bathrooms.

Vertical blinds in all rooms except kitchens & bathrooms.

Clear site and clean throughout.

UK Financials:

Acquisition Costs

| Purchase Price Sale agreed | £155,000 |

| Renovation Refurbishment & Conversion Costs | £60,000 |

| Architect Technical drawings for approval by HMO officer | £1,250 |

| Furniture Furnishing to provider’s requirements | £4,500 |

| SDLT:Resi Stamp Duty Land Tax | £4,650 (UK) £7,750 (INT) |

| Survey RICS Level 2 Report | £500 |

| Legals Conveyancing & transaction fees & disbursements | £2,500 |

| Sourcing Sourcing Fee | £8,750 |

| Equity Invested Total acquisition costs excluding finance | £238,200 |

Rental Income (Term: 10-Year Lease)

| Rooms | 6 |

| Average Rate/Wk | £0 |

| Gross Rent p.a. Negotiated rate for area | £28,080 |

| Operational Expenses p.a. @0.00% | £0 |

| Mortgage p.a. @6.00% lending @.75% LTV | £7,650 |

| Net Cash Flow p.a. Pre-tax income | £23,430 |

| Term (years) | 10 |

Returns

| Net Cash Flow PA Annual net income after costs | £20,430 |

| Contract Lifetime Net Cash Flow Private finance investor partner net income over the life of lease term (10 years) | £205,902 |

Rental Income (Term: 10-Year Lease)

Yield

14.40%

Cash-on-Cash UK

18.46%

International Financials:

Acquisition Costs

| Purchase Price Sale agreed | £155,000 |

| Renovation Refurbishment & Conversion Costs | £60,000 |

| Project Management @10% of cost of works | £0 |

| Architect/Planning Technical drawings for approval by HMO officer | £1,250 |

| Building Control UK | £0 |

| Furniture Furnishing to provider’s requirements | £4,500 |

| SDLT:Resi Stamp Duty Land Tax | £7,750 |

| Survey RICS Level 2 Report | £500 |

| Legals Conveyancing & transaction fees & disbursements | £2,500 |

| Insurance | 0 |

| Sourcing Sourcing Fee | 0 |

| Equity Invested Total acquisition costs excluding finance | £238,200 |

Rental Income (Term: 10-Year Lease)

| Rooms | 6 |

| Average Rate/Wk | £0 |

| Gross Rent p.a. Negotiated rate for area | £28,080 |

| Operational Expenses p.a. @0.00% | £0 |

| Mortgage p.a. @6.00% lending @.75% LTV | £7,650 |

| Net Cash Flow p.a. Pre-tax income | £23,430 |

| Term (years) | 10 |

Returns

| Net Cash Flow PA Annual net income after costs | £20,430 |

| Contract Lifetime Net Cash Flow Private finance investor partner net income over the life of lease term (10 years) | £205,902 |

Rental Income (Term: 10-Year Lease)

Yield

14.40%

Cash-on-Cash UK

18.46%

Comparables

Secure Your Next Deal Today:

This deal is available under our standard terms with a 25% downpayment of the Sourcing Fee paid to secure the opportunity, deductible from the final balance due at Exchange of contracts.

Please fill in your information below if you would like to to discuss this opportunity in more detail…

"*" indicates required fields