5 bed HMO, Victory Road, Cadishead, Manchester M44 5EB

Project:

Background & Deal Structure:

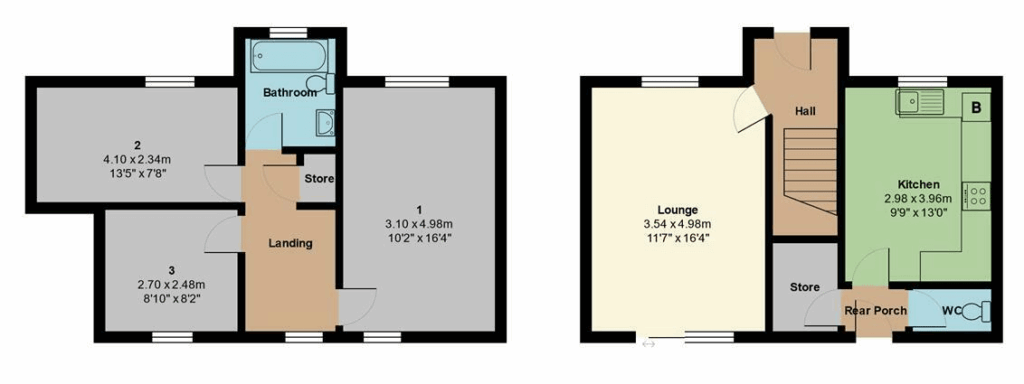

A 3-bedroom terraced property ideally suited for conversion into a 5 bedroom house of multiple occupancy (HMO) and leased to a Registered Provider on a long-term commercial lease.

The Registered Provider (RP) has expressed interest in this property, and it has passed their postcode checks.

The RP have offered a 5 year lease on this unit, following renovation and having onboarded the property.

Deal requires cash or bridge for the front-end purchase due to the scope of works.

Area / Location

Located close to the centre of town, with an abundance of local amenities and facilities, a short distance to the train station and motorway networks providing access to Manchester, Liverpool and beyond, Cadishead is well located.

The property is perfectly positioned for access into the town, is in close proximity to many local, national and global employers, and benefits from a variety of local recreation spots including local golf courses, parks and forests.

Scope of Work

- TBC

Video Walkthrough:

Financials:

Acquisition Costs

| Purchase Price Sale agreed | £196,000 |

| Renovation Refurbishment & Conversion Costs | £45,000 |

| Architect/Planning Budget for plans drafting plans and submission to local authority | £675 |

| Building Control Estimated cost for compliance inspections & sign-off | £700 |

| Furniture Furnishing to provider’s requirements | £4,200 |

| SDLT Stamp Duty Land Tax | £9,800 UK £13,720 INT |

| Survey Chartered surveyor onsite inspection and report | £550 |

| Legals Conveyancing & transaction fees & disbursements | £2,500 |

| Insurance Buildings insurance to cover the reinstatement value | £550 |

| Sourcing Sourcing Fee | £8,750 |

| Capital In Total acquisition costs | £268,725 |

Optional Extras

| Project Management Coordinating contract teams | £4,500 |

| Lease Setup Lease negotiations & contract with Registered Provider | £2,383 |

Post Works Refinance

| Gross Development Value Bricks & mortar valuation | £225,000 |

| Uplift Between GDV and original purchase price | £29,000 |

| 1st Charge Lending @75.00% of GDV – recycling funds onto next opportunity | £168,750 |

| Capital Left In Capital remaining in equity post-refinance using mortgage lending | £99,9750 |

Rental Income

| Gross Rent p.a. Negotiated rate for area | £28,600 |

| Mortgage p.a. @6.00% lending @75%LTV | £10,125 |

| Operational Expenses p.a. @0.00% | £0 |

| Management p.a. @0.00% | £0 |

| Net Cash Flow p.a. Pre-tax income | £18,475 |

Capital Growth

Capital Gain

| Capital Value @ Year 10 Year 10 value assumed conservative 3.5% annual growth | £317,385 |

| Mortgage Lending 1st Charge lending redemption | £168,750 |

| Equity Investment Capital Capital returned to equity investor | £99,975 |

| Capital Gain @ Year 10 Cap.value less 1st charge lending & equity investor’s capital | £48,660 |

Investor Return

Income & Return

| Net Cash Flow PA Annual net income after costs | £18,475 |

| Total Net Lifetime Cash Flow Net income over life of lease term | £184,750 |

| Total Lifetime Return on Capital Gain + Total Income (calculated @Year 10) | £233,410 |

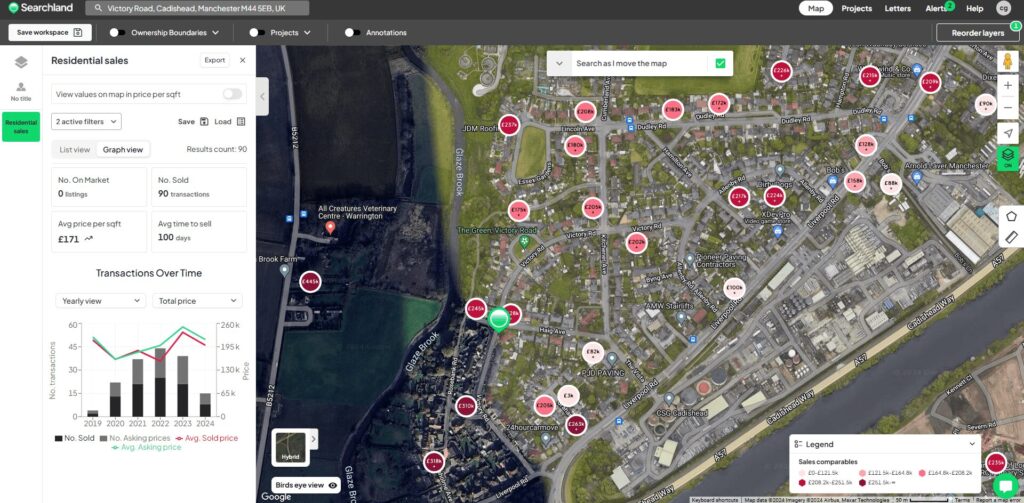

Comparables

Secure Your Next Deal Today:

This deal is available under our standard terms with a 25% downpayment of the Sourcing Fee paid to secure the opportunity, deductible from the final balance due at Exchange of contracts.

"*" indicates required fields