4 bed HMO , Dryden Way, Egremont CA22 2HA

Project:

Background & Deal Structure:

A 3 bedroom semi-detached property requiring a small amount of adaptation, ideally suited for conversion into a 4 bedroom house of multiple occupancy (HMO) and leased to a Registered Provider on a long-term commercial lease.

The Registered Provider (RP) Serco have expressed interest in this property, and it has passed their postcode checks.

The RP have offered a 10 year lease on this unit, following renovation and having onboarded the property.

This property is a Corporate Sale (a repossession). Instructions to have the listing removed from marketing/further viewings are

1. Book the survey

2. Book searches

We are able to arrange these items within 24 hours.

Area / Location

Located close to the centre of town, with an abundance of local amenities and facilities, a short distance to the train station and motorway networks providing access to Carlisle and beyond, Egremont is well located.

The property is perfectly positioned for access into the town, is in close proximity to many local, national and global employers, and benefits from a variety of local recreation spots including local golf courses, parks and forests.

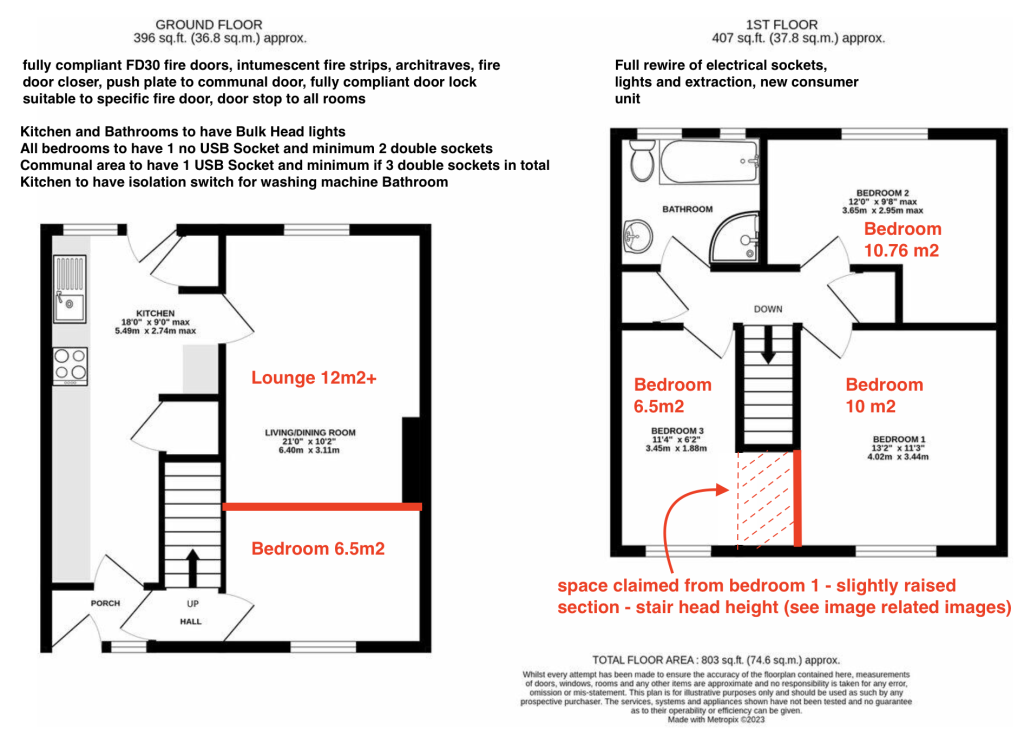

Scope of Works

Rip out only carpets, door casings, etc as required.

Form new partition wall to make GF bedroom at the front of the property, insulate, plasterboard, supply and fit skirting to both sides and install new doorway c/w with fire-door.

Form new partition wall in bedrooms 2 & 3 to enlarge bedroom 3 on the 1st floor, insulate, plasterboard, supply and fit skirting to both sides.

Carry out all other associated joinery works throughout the property to make good existing woodwork, skirting boards etc.

Strip walls if required and re-plaster full wall if re-plaster is required. Plaster all newly formed partition walls and around removal of existing walls/structural openings etc.

NOTE: WHERE WALLS HAVE TEXTURED COVERINGS AND REQUIRE ANY PLASTER THEN FULL WALL WILL BE STRIPPED TO ACHIEVE SMOOTH FINISH. NO IRREGULAR FINISHES/PATCHES.

Install smoke & heat detection, interlinked smoke detection to all rooms and corridors and 1 heat detector in the kitchen area. Full rewire of electrical sockets, lights and extraction, new consumer unit EICR test and two EML fittings Kitchen and Bathrooms to have Bulk Head lights. All bedrooms to have 1 no USB Socket and minimum 2 double sockets Communal area to have 1 USB Socket and minimum if 3 double sockets in total Kitchen to have isolation switch for washing machine. Bathroom and WC to have extraction fans.

Supply and fit new fully compliant FD30 fire door casings, fully compliant FD30 fire doors, intumescent fire strips, architraves, fire door closer, push plate to communal door, fully compliant door lock suitable to specific fire door, doorstop to all rooms.

- Fire-board under stairs and to any supply cupboards etc.

- New flooring where required, look to save part of existing floors if possible.

- Possibly new kitchen worktops and additional sockets.

- Full redecoration of all walls, ceilings and woodwork in white throughout the whole house.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

UK Financials:

Acquisition Costs

| Purchase Price Sale agreed | £176,800 |

| Renovation Refurbishment & Conversion Costs | £0 |

| Project Management @10% of cost of works | £0 |

| Architect/Planning Technical drawings for approval by HMO officer | £0 |

| Building Control UK | £0 |

| Furniture Furnishing to provider’s requirements | £0 |

| SDLT:Resi Stamp Duty Land Tax | £5,304 |

| Survey RICS Level 2 Report | £0 |

| Legals Conveyancing & transaction fees & disbursements | 2,500 |

| Insurance | 400 |

| Sourcing Sourcing Fee | 0 |

| Equity Invested Total acquisition costs excluding finance | £185,004 |

Rental Income (Term: 10-Year Lease)

| Rooms | 4 |

| Average Rate/Wk | £68.00 |

| Gross Rent p.a. Negotiated rate for area | £14,114 |

| Operational Expenses p.a. @0.00% | £0 |

| Management p.a. 0.50% | £0 |

| Net Cash Flow p.a. Pre-tax income | £14,114 |

| Rent/m (rm rate reverse calc) | £1178.67 |

| Term (years) | 10 |

Returns

| Equity Invested | £185,004 |

| Net Cash Flow PA Private finance investor partner net income | £14,114 |

| Contract Lifetime Net Cash Flow Private finance investor partner net income over the life of lease term (10 years) | £141,440 |

Rental Income (Term: 10-Year Lease)

Yield

8.00%

Cash-on-Cash UK

7.65%

International Financials:

Acquisition Costs

| Purchase Price Sale agreed | £176.800 |

| Renovation Refurbishment & Conversion Costs | £0 |

| Project Management @10% of cost of works | £0 |

| Architect/Planning Technical drawings for approval by HMO officer | £0 |

| Building Control International | £0 |

| Furniture Furnishing to provider’s requirements | £0 |

| SDLT:Resi Stamp Duty Land Tax | £8,840 |

| Survey RICS Level 2 report | £0 |

| Legals Conveyancing & transaction fees & disbursements | £2,500 |

| Insurance | £400 |

| Sourcing Sourcing Fee | £0 |

| Equity Invested Total acquisition costs excluding finance | £188,540 |

Rental Income (Term: 10-Year Lease)

| Rooms | 4 |

| Average Rate/Wk | £68.00 |

| Gross Rent p.a. Negotiated rate for area | £14,144 |

| Operational Expenses p.a. @0.00% | £0 |

| Management p.a. 0.50% | £0 |

| Net Cash Flow p.a. Pre-tax income | £14,144 |

Returns

| Equity Invested | £188,540 |

| Net Cash Flow PA Private finance investor partner net income | £14,144 |

| Contract Lifetime Net Cash Flow Private finance investor partner net income over the life of lease term (10 years) | £141,440 |

Rental Income (Term: 10-Year Lease)

Yield

8.50%

Cash-on-Cash UK

7.99%

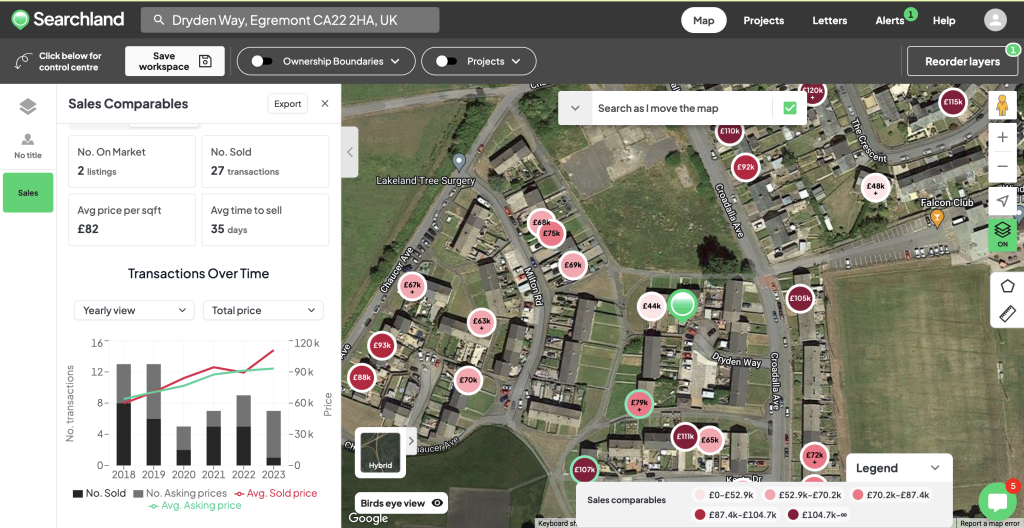

Comparables

Secure Your Next Deal Today:

This deal is available under our standard terms with a 25% downpayment of the Sourcing Fee paid to secure the opportunity, deductible from the final balance due at Exchange of contracts.

Please fill in your information below if you would like to discuss this opportunity in more detail…

Post Opportunity Form

"*" indicates required fields