4 bed HMO

Mulberry Road, Birkenhead

Project

Background

& Deal Structure

A 3 bedroom mid-terraced property requiring modernisation, ideally suited for conversion into a 4 bedroom house of multiple occupancy (HMO) and leased to a Registered Provider on a long-term commercial lease.

We have an established relationship with a Registered Provider (RP) who expressed interest in this property, after passing all their criteria checks.

The RP offered a 10 year lease on this unit, following renovation and having onboarded the property.

Location

Images

Video Walkthrough

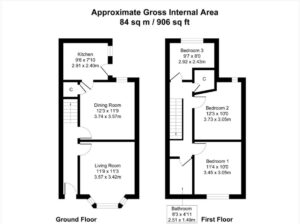

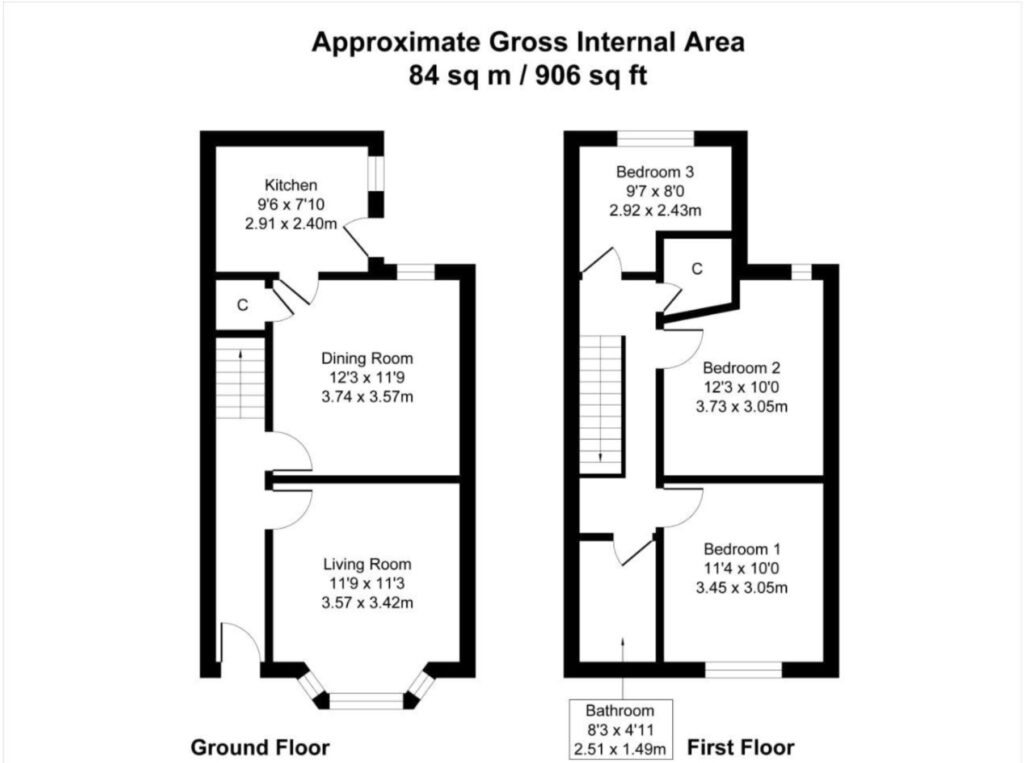

Floorplans

Scope of Works

- Part rewire – addition of extra sockets

- Interlinked smoke alarms

- New Boiler located in new position

- Double glazing unit replacements x 1

- Running repairs to DG units

- Fire doors x 5

- Knock-through stud partition back bedroom. Board & skim entry. Possible drop floor to make full room usable (TBC).

- Bathroom light & fan

- Create archway between existing dining and living room

- Stud partition in living room with entry point to create 4th bedroom

- Part Skim – studs

- Part Decor

- Part Flooring – 3 rooms

- Jet-wash yard

Financials

Acquisition Costs

| Purchase Price Sale agreed | £105,000 |

| Renovation Refurbishment & Conversion Costs | £23,000 |

| Architect Technical drawings for approval by HMO officer | £650 |

| Furniture Furnishing to provider’s requirements | £3,000 |

| SDLT Stamp Duty Land Tax | £3,150 UK £5,250 INT |

| Survey RICS Level 2 report | £420 |

| Legals Conveyancing & transaction fees & disbursements | £1,500 |

| Sourcing Sourcing Fee | £4,000 |

| Capital In Total acquisition costs | £140,720 |

Post-Works Refinance

| Gross Development Value Bricks & mortar valuation | £115,000 |

| Uplift Between GDV and original purchase price | £10,000 |

| 1st Charge Lending @75.00% of GDV – recycling funds onto next opportunity | £86,250 |

| Capital Left In Capital remaining in equity post-refinance using mortgage lending | £54,470 |

Registered Provider 10 Year Lease

| Gross Rent p.a. Negotiated rate for area | £12,480 |

| Mortgage p.a. @6.00% lending @75%LTV | £5,175 |

| Operational Expenses p.a. @0.00% | £0 |

| Management p.a. 0.00% | £0 |

| Net Cash Flow p.a. Pre-tax income | £7,305 |

Capital Growth

Capital Gain

| Capital Value @ Year 10 Year 10 value assumed conservative 3.5% annual growth | £162,219 |

| Mortgage Lending 1st Charge lending redemption | £86,250 |

| Equity Investment Capital Capital returned to equity investor | £54,470 |

| Capital Gain @ Year 10 Cap.value less 1st charge lending & equity investor’s capital | £21,499 |

Investor Returns

Income & Return

| Net Cash Flow PA Annual net income after costs | £7,305 |

| Total Net Lifetime Cash Flow Net income over life of lease term | £73,050 |

| Total Lifetime Return on Capital Gain + Total Income (calculated @Year 10) | £94,549 |